Ultimate Guide to Employee Benefits in Kenya (2026 Edition)

Great benefits aren’t a corporate luxury; they’re the slingshot that lets Kenyan businesses out-compete the giants. Nail your business employee benefits in Kenya and watch top talent come running to your door.

Table of Contents

The Business Case for Stellar small Business employee benefits in Kenya

Kenya’s unemployment rate is below, but skilled-worker demand keeps climbing in tech, finance, health and logistics.

| Metric | 2023 | 2024 (most-recent) | Data Source |

|---|---|---|---|

| Overall unemployment — ILO/World Bank “strict” definition | 5.6% | 5.4% | Trading Economics & World Bank Open Data |

| Youth unemployment (ages 15-24) | 12% | 11.93% | Macrotrends |

| Broader unemployment (FKE estimate*) | 12.7% | n/a (last update 2024) | fke-kenya.org |

* FKE’s figure includes discouraged job-seekers and other forms of labour under-utilisation, so it is noticeably higher than the “strict” ILO/World Bank rate.

In this climate, small business employee benefits in Kenya deliver three strategic wins:

| Goal | How Benefits Help | Proof Point |

|---|---|---|

| Attract talent fast | Signal professionalism, stability and care | 42% of Kenyan job-seekers accepted a lower base salary when the benefits were compelling. |

| Retain high performers | Reduce “flight risk” triggers | Boosted average tenure by 19% at SMEs that added Group Medical + Flex-Time. |

| Elevate productivity | Healthier, happier staff work smarter | 1 extra productive hour per employee per week when wellness perks are present. |

Bottom line: Pouring 5–10% of payroll into thoughtful small Business employee benefits can return 15–30% in saved recruitment fees, reduced absenteeism and improved productivity.

Statutory Contributions & Financial Obligation

Kenyan law requires employers to stay current on all statutory contributions and remittances, and falling behind can attract steep fines or even jail time.

| Deduction / Obligation | 2026 Rule | Why It Matters |

|---|---|---|

| NSSF Pension (Tier I & II) | Levy compliance unlocks reimbursement of staff-training costs, use it to fund CPD and boost retention. | Secures staff retirement savings; late or under-remittance attracts surcharges and can disqualify the business from public tenders. |

| SHIF Healthcare | Mandatory 2.75% of gross salary, min KES 300, no cap; remit by the 9ᵗʰ of the following month; penalties up to KES 2 m or 3 yrs jail for non-compliance. | Non-remittance compounds fast; the employer portion is tax-deductible, so you can offset it against corporation tax. |

| Affordable Housing Levy | 1.5% of gross salary by employee + 1.5% by employer; due by the 9ᵗʰ; penalty = 3 % of unpaid amount per month. | Non-remittance compounds fast; employer portion is tax-deductible, so you can offset it against corporation tax. |

| WIBA Insurance | Employer must hold an approved WIBA policy covering workplace injury & disease; failure = fine ≤ KES 100k or 3 mths jail (Sec 7(4)). | Shields the firm from injury lawsuits and mandatory compensation awards; a combined WIBA + 24-hr GPA bundle usually costs < 1% of payroll. |

| NITA Industrial Training Levy | Flat KES 50 per employee per month (paid by employer, not deducted from salary); payable by the last working day of the month. | Levy compliance gets you reimbursement of staff-training costs, use it to fund CPD and boost retention. |

Statutory Leave & Employment Entitlements

Beyond deductions, the Employment Act (Cap 226) bakes paid-time-off rights directly into small business employee benefits in Kenya:

| Leave Type | Entitlement | Best-practice Nugget |

|---|---|---|

| Annual | 21 working days | Encourage staggered leave blocks to avoid quarter-end crunches. |

| Maternity | 90 calendar days | Offer an optional unpaid extension, fathers value the choice. |

| Paternity | 14 calendar days | Offer an optional unpaid extension fathers value the choice. |

| Sick | 14 days (7 full/7 half pay) | Pair with Group Medical to limit downtime and costs. |

| Public holidays | Paid day off or double pay | Use shift scheduling tools to predict peak-demand days. |

| Termination notice | 28 days or pay in lieu | Document exit interviews; insights feed back into benefits design. |

| Redundancy severance | 15 days’ basic pay per year served | Plan restructuring budgets with this formula baked in. |

Consistently weaving these statutory items into your small business employee benefits handbook demonstrates legal savvy and empathy.

Core Insurance Benefits Every SME Should Price

Insurance is the safety net that turns compliance into true protection, shielding your people and your profit margins when life takes an unexpected turn. By pricing these core covers upfront, SMEs lock in bulk discounts, simplify claims, and transform their small business employee benefits in Kenya package from basic to great.

Group Medical Cover

- Inpatient tiers: KES 500k → 10 M.

- Popular add-ons: Outpatient, dental, optical, wellness checks, chronic disease management.

- Underwriting tip: Pool staff + dependents to hit 20 lives premiums drop ~7%.

Group Life & Last Expense

- Life cover: 3-4× annual salary standard.

- Last expense: KES 100k–250k for funeral costs paid within 48 hours.

- Tax angle: Premiums are deductible, and benefits are PAYE-free to the beneficiary.

24-Hour Group Personal Accident (GPA)

- Covers: Accidental death, permanent disability, medical expenses, and funeral.

- Ideal for: Field teams, logistics, and construction.

Critical Illness & Disability Riders

- Trigger events: Cancer, heart attack, stroke, and kidney failure.

- Pay-out: Lump sum to cover treatment or lifestyle adjustments.

Supplementary Pension Top-Up

- Mechanic: Employees contribute above NSSF cap; you match 50–100 %.

- Stickiness: Turnover drops sharply among staff who invest in this benefit.

Takeaway: These five insurance pillars form the backbone of competitive business employee benefits in Kenya. Bundle them for synergy and discounts.

Monetary Rewards That Move the Needle

Money still talks. Layer these cash-flow hits onto your core salary grid:

- Performance Bonuses: Tied to quarterly OKRs.

- Transport & Fuel Allowance: Index to AA Kenya mileage rates.

- Lunch or Airtime Stipends: Digital vouchers cut admin time by 60%.

- Education Grants: Refund exam fees upon passing.

- Sacco or MMF Top-Ups: Help staff build an emergency fund.

- ESOPs & Phantom Shares: Perfect for high-growth tech SMEs.

Pro-tip: Cap variable pay at 20% of total compensation so fixed costs remain predictable yet your small Business employee benefits in Kenya stay impressive.

Non-Monetary Perks Employees Rave About

Paychecks fade from memory, but daily experiences stick, and it’s the “little big” perks that make employees brag about where they work. Thoughtfully chosen non-monetary employee benefits in Kenya cost a fraction of cash rewards yet increase loyalty, well-being, and word-of-mouth recruiting power.

| Category | Perk | Why It Resonates |

|---|---|---|

| Flexibility | Remote Fridays, flex hours | Cuts commute stress; boosts job satisfaction. |

| Well-being | EAP hotline, mental-health days | Addresses rising anxiety & burnout. |

| Growth | Annual KES 30k learning wallet | Signals career investment. |

| Recognition | Peer-to-peer shout-out app | Instant morale lift, low cost. |

| Workspace | Ergonomic chairs, quiet pods | Reduces back pain, increases focus. |

| Family | School-fee advance scheme | Eases cash-flow crunch in January. |

Sprinkling these culture-rich perks among your small business employee benefits makes your EVP (Employee Value Proposition) unforgettable.

Emerging Benefit Trends for 2026 +

- Digital-first benefits portals with self-service claims.

- Climate-friendly perks: tree-planting days, carbon-offset commutes.

- Financial-wellness coaching: Budgeting, debt management, investing.

- Inclusive family benefits: adoption grants, fertility support.

Stay ahead of the curve, and your small business employee benefits in Kenya will feel progressive, not perfunctory.

Tax, Audit & Compliance Checkpoints

- PAYE vs. Benefit-in-Kind rules: Structure housing or car benefits under allowable caps to avoid surprise tax.

- Fringe-benefit tax on cheap loans: Charge ≥ Treasury Bill rate to sidestep FBT.

- Premium deductibility: WIBA, Group Medical, and Group Life are fully deductible if paid via the business bank account.

- Record retention: Keep SHIF, NSSF & WIBA schedules for a 5-year KRA audit window.

A tight tax approach keeps your small business employee benefits in Kenya financially sustainable.

Step-by-Step Roadmap to Build a Winning Plan

- Gather data: Payroll, turnover costs, absentee records, staff surveys.

- Set objectives: E.g., cut attrition < 10 %, boost offer acceptance to 85 %.

- Create employee personas: Graduate trainee, mid-career pro, senior manager.

- Benchmark: Use Amssurity SME Benefits Index to see what peers offer.

- Model budgets: Allocate 5 % payroll to start; scale successful perks.

- Choose providers: Shortlist three insurers or benefit vendors.

- Communicate: Launch handbook, Q&A town hall, Slack FAQ bot.

- Measure & iterate: Track uptake, claims, engagement-survey scores quarterly.

Following this playbook ensures your small business employee benefits in Kenya remain aligned with business goals.

Sample ROI Calculator

Scenario: 30-employee marketing agency adds Group Medical (KES 1.5 M limit) and Flexible Fridays.

| Metric | Before | After | Net Gain |

|---|---|---|---|

| Annual turnover rate | 22 % | 12 % | Saved 3 rehiring cycles = KES 600k |

| Sick-day average | 6.2 days | 4.1 days | Gained 63 productive days = KES 315k |

| Premium cost | n/a | KES 540k | — |

| ROI | — | — | 1.7 × in year 1 |

Even conservative numbers prove that small business employee benefits in Kenya are a profit centre.

How Amssurity Makes Benefits Effortless

- One-stop broking: Compare 10+ insurers in minutes.

- Claims concierge: 24-hour WhatsApp line for hassle-free reimbursements.

- Year-round advice: Quarterly utilisation reports + renewal negotiations.

- Digital onboarding: Employees add dependents or file claims via the app.

Partnering with Amssurity Insurance turns cumbersome small business employee benefits in Kenya into a seamless, data-driven advantage.

Frequently Asked Questions

What counts as small business employee benefits in Kenya?

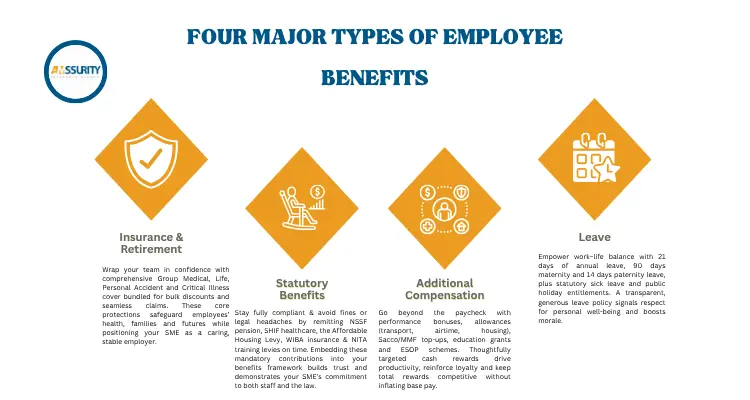

Anything beyond basic salary that helps attract, protect or motivate staff, statutory contributions (NSSF, SHIF, WIBA), insurance (Group Medical, Life, GPA), monetary perks (bonuses, allowances) and non-monetary perks (flex-time, wellness, training).

Are business employee benefits mandatory for micro-enterprises (<10 employees)?

Yes. Even one-person companies must remit NSSF, SHIF and the Affordable Housing Levy, plus carry WIBA insurance. Optional benefits (medical, bonuses, flex-time) become your competitive edge.

How much should an SME budget for employee benefits in Kenya?

A starter benchmark is 5–10% of payroll. Statutory items take about ~3 %; the balance funds insurance, cash perks and culture add-ons. Measure ROI annually and scale what works.

Can I offer different benefit tiers to managers vs. entry-level staff?

Yes, as long as statutory minimums are met for everyone. Tiered benefits (e.g., higher medical limits for senior staff) are common and legal when transparently documented in contracts.

Are employer-paid medical and pension premiums tax-deductible?

Absolutely. Group Medical, Group Life, WIBA, GPA and employer pension contributions are allowable business deductions under the Income Tax Act, lowering your taxable profit.

Key Takeaways & Next Steps

- Competitive small Business employee benefits in Kenya protect people and profits.

- Combine statutory compliance, smart insurance, targeted monetary rewards and culture-rich perks.

- Track ROI benefits that can’t be measured often get cut in lean times.

Crafting irresistible, compliant and cost-effective small business employee benefits in Kenya isn’t magic, it’s strategy. Implement the steps above, and your SME will transform benefits into a growth engine for 2025 and beyond.