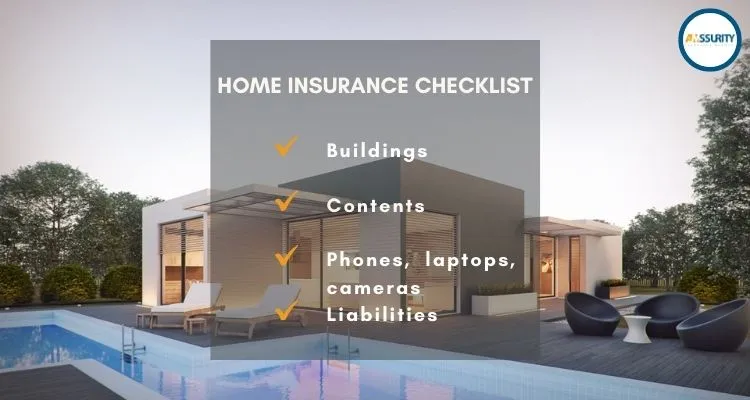

Proven 5 Domestic Package Insurance Checklist

Domestic package insurance, which is also called home insurance Kenya, is one of the most underestimated insurance plans one can ever have. Not only is it cheap, but it also covers a wide variety of risks and losses, as we shall be discussing in this article. According to Knoema, we have 3 burglary cases for every 100,000 people in Kenya as of 2018. However, these could be the only reported cases, hence the number could be higher. Then we have the usual muggings and phone snatchings at Muthurwa roundabout or at Ngara. This list is endless.

As you already know, Amssurity Insurance Agency aims to educate you and allow you to become your own insurance expert, and this includes the domestic package insurance policy as well. We shall look at the 5 checklist areas you need to have a look at, as well as explain what is covered and what is not. The domestic package insurance policy in Kenya comes in many names such as home insurance, renters insurance, and landlord insurance.

This article will discuss the domestic package insurance definition in detail and in bits that are easy to understand.

Table of Contents

Building Section Under Domestic Package Insurance

This section is usually ideal for landlords and residential premises against various risks. Just as the name suggests, it covers your building against major catastrophes such as fire, flooding, burst pipes, and water tanks, damage caused by the forceful entry or exit during a robbery, lightning, and earthquakes just to mention a few risks and covers a dwelling. These are the most commonly asked for areas of coverage by you our dear reader as well as our clients.

To ensure this, you must be able to provide the plot number of where the building is located and list what kind of activities are carried out there other than residential. This can include a shop or a small tuckshop. You might also be asked to state what takes place in your neighboring buildings. Are you close to a factory or other residential areas, for example? This is because less risk near your building means lower premiums and vice versa. Other factors that might make your premiums cheaper would include nearness to a fire station or a water source.

You might also be required to provide your latest valuation report of the building. We recommend this so that you can be adequately compensated in the event of a major loss. Remember, this might be not asked but it is highly recommended. Therefore, get your property valued and enjoy better coverage for your domestic package insurance in Kenya. This section is not compulsory for non-homeowners.

Contents Section Under Domestic Package Insurance

This is where most the non-homeowners lie. Hence, this becomes compulsory to have in order to enjoy the domestic package insurance policy in Kenya. It provides home appliances insurance Kenya. It covers content in your home such as beds, sofas, dining table sets, bedding, fridges, cookers, gas cylinders, clothes, and utensils contents against specified perils. To help you get the picture, think of anything that doesn’t leave the house or isn’t easily moved.

It covers losses as a result of fire, theft, flooding, and bursting of pipes, among others. The area of coverage is similar to those covered under the building section. Don’t panic, home insurance will have you covered. You can even negotiate for what is called Electrical Clause 3, which takes care of losses in the event of electrical short-circuiting or low or high voltage damages as well.

Domestic Package Insurance All Risk Section

Just as the name suggests, this covers anything that cannot be covered under the above-discussed sections. This section covers things that are with you outside your home. These include items such as your cameras, jewelry, watches, laptops, phones, smart TVs, and bicycles, just to mention a few. The domestic package insurance policy will state that the cover is a worldwide cover, meaning these items will be covered even when you are out of your country of residence.

There are two things that you need to know about this policy:

- Depending on the insurance company policy, some items in this section (e.g., rings of above KES. 50,000) might need valuation if you do not have receipts or a valuation of the same.

- Unexplained losses are not covered. Please note you will be required to have a police abstract for theft instances and cases.

Domestic Help Section

In your domestic package insurance policy, there is a section in which your domestic help is covered. This includes your domestic help/manager, your gardeners, and watchmen. Please note some companies have free coverage for one domestic help, meaning if you have extra you will need to pay a small additional fee for the extra domestic help. In most cases, it is usually 500 shillings per person.

Please note the same benefits that apply to the WIBA insurance given to employees working for the businesses that operate in Kenya are the same benefits that apply here. These benefits include:

- 96-month salary in the event of death at work;

- Permanent total disability while at work as specified by the policy;

- 52-week salary in event of temporary disability as defined by the policy;

- Medical expenses as defined in the policy; and

- Funeral expenses as defined in the policy.

The claim process is similar to that of WIBA as per insurance guidance. (To be discussed in an upcoming blog article).

Ensure you have a signed contract with all your domestic staff outlining all their duties and responsibilities, their monthly salary as well as their days off. Keep a signed copy and issue a copy of the same to the domestic help for their records.

www.amssurity.co.ke

Liability Section

Most domestic package insurance policies offer some free limit for liability that might arise from renting or owning a home. The limits of liability will be specified in the policy, and the amount varies from one insurance company to another. In the event you feel these limits might be below, you can always top up some additional premiums to get extra coverage.

The liabilities covered are as discussed below.

Occupiers’ Liability under Domestic Package Insurance

This applies to both renters and building owners. It is the legal duty of care owed to people who visit the building legally. For example, this includes the KPLC employee who comes to read your meter and is bitten by your dog, or something falls on him, or a postal delivery rider coming to deliver that Jumia package you have been waiting for, just to mention a few. This coverage also applies to children who come visiting.

In the event that someone suffers an injury while within your premises, they might sue you, and hence this insurance can take care of damages arising out of this legal action up to the specified policy limit. If the awarded damages exceed what your policy allows for, you will pay the difference from pocket. This coverage excludes trespassers.

Personal Liability under Home Insurance Kenya

This specifically covers guests getting injured while visiting your home, which includes your friends. There is a legal duty of care owed to any guest coming to visit you in the event of getting injured while at your home. This includes damage to another person’s property. This section applies to both renters and homeowners. It takes care of medical expenses, legal fees, and any damages they might be awarded by a court of law up to the specified limit of the policy. Any extra damages over and above the specified limit of the policy will be paid out of pocket.

The domestic package insurance policy in Kenya is one of the few extremely comprehensive and affordable packages we would recommend to any person seeking to ensure their assets and investments are well protected.