15 Excellent reasons to have home insurance in Kenya

The best home insurance in Kenya is designed to cover the house, house contents domestic employees and liabilities that you as the homeowner or renter would be exposed to. We have discussed the structure of home insurance in detail in one of our blog articles. Home insurance in Kenya is also called domestic package insurance Kenya and it is also the most affordable insurance plan.

Table of Contents

What are the 2 types of home insurance in Kenya?

When it comes to domestic package insurance, you need to appropriately pick the type of insurance cover that is designed specifically for you. In this section, we shall look at the two types of home insurance plans that are available depending on what you want to cover. We shall discuss at length the two main types of home insurance in Kenya. Which type of insurance covers homes?

Landlords and Homeowners

As a landlord who owns rental residential properties, this would be the best plan for you. As for this category of people, we shall look into the ways in which insurance companies will look into it:

Landlords

As a landlord, your insurable interest is in the building but not in the content inside the property, therefore, you will need only be required to fill in section one of the proposal document which will cover the building structure, and section 5 which will cover the liability that might come from the use of the property by the third parties.

Home insurance in Kenya defines a residential building as residential premises including but is not limited to landlords’ fixtures and fittings and the following, in so far as they form part of the property; walls, gates, fences, terraces, patios, drives, paths, carports, garages, and outbuildings.

Homeowners

Insurance defines a home under home insurance in Kenya as a private dwelling used for domestic purposes only. What this means is that this is the dwelling where the insured is staying together with their family and is not for renting out.

What is covered?

- Fire, lightning, thunderstorms, earthquakes, or volcanic eruptions. This also includes flooding.

- Explosions

- Riots, strikes, and civil commotion

- Malicious damage caused by any other person other than a person of the insured household

- Aircraft or other aerial devices or any article dropped

- Bursting or overflowing or escape of water from tanks, pipes, and other apparatus. This clause regarding home insurance in Kenya proceeds to add that damage arising from this will not be covered if the damage is caused by the insured or if the house was left unoccupied for more than 30 days.

- Theft must show there was the force used or violence to break into the building. This clause also proceeds to indicate that it shall not cover damage arising from unoccupied buildings for more than 30 days.

- Impact to the building arising from vehicles, animals, falling trees or branches (this excludes damage caused by the insured if they are tree felling or lopping) and aerial, aerial fittings or masts, satellite dishes, lamp post, and electrical overhead cables, telegraph poles or pylons.

- Damage caused by wind, storms, or tempest

- Additional expenses of alternative accommodation and loss of rent if the damage is caused by any of the above-stated causes of loss in your home insurance policy. The clause will also specify that the amount recoverable is subject to either 10% or whatever each insurer has set as a limit. Sometimes you can opt to have this amount extended to whatever amount you need subject to paying an additional premium

What is not covered

- Fire, explosions, malicious damage, riots, strikes, loss, damage, and expense liability that is caused by either directly or indirectly overthrowing a government, or influencing it by terrorism or violence

- Any of the above stated caused as a result of the action of the government, public municipal, or local authority

- Consequential loss of any kind except for the 10% allocated towards alternative accommodation.

Which insurance is best for property?

When it comes to property insurance in Kenya, as a property owner you need to know that your investment has ways in which it can be covered. Please note insurance companies have a guideline on what consists of residential and industrial buildings. So ensures you get to understand what works for you.

For industrial buildings and commercial buildings, it is important to note that you need what is called fire and special perils cover which is geared specifically to the nature of the use of the building. Any loss of profits or revenue will require you to get an additional cover called fire consequential loss which we shall be discussing later.

Home insurance products that cover your belongings

This cover is ideal for people who are either homeowners and /or are renters and tenants.

The content insurance cover under home insurance in Kenya is designed to cover the following products that cover your belongings

- Furniture

- Household goods

- Personal effects which include clothing, luggage, containers, briefcases, trinkets, and toilet requisites

- Any fittings and fixtures that the insured is directly responsible for.

What is covered

- Fire, lightning, thunderstorms, earthquakes, volcanic eruptions.

- Explosions

- Riots, strikes, and civil commotion

- Malicious damage caused by any person other than a member of the insured household.

- The impact of dropping things from aerial devices and aircraft

- Damage caused by burst pipes, overflowing or escaping water

- Theft, where there is evidence of forceful entry and/or violent breaking in, theft from an outbuilding, verandah, and theft that occurs if the house is left unoccupied for more than 7 consecutive days unless there is a watchman, continues to guard unoccupied premises.

- Impact to content caused by vehicles, animals, falling trees and branches and aerials, electric and overhead cables.

- Windstorms, tempest, and flooding.

All risks insurance

Sometimes we like to call this home appliances insurance Kenya as it extends to cover your precious valuable items such as watches, jewelry, metals, photographic equipment/cameras, binoculars, artworks and paintings, TVs, radios and sound systems, bicycles, computers, laptops, phones, your precious collection of stamps, coins, or medals. Home insurance in Kenya covers this under section C of the policy.

What is covered?

The home insurance in Kenya cover is rather very straightforward as it considers either loss and/or damage of any nature or cause unless as stipulated in your home insurance policy in Kenya (we shall look at some of these exceptions below) during the insurance period.

The cover extends to either anywhere in Kenya or worldwide depending on your insurance company.

What are the exceptions to the gadget cover?

What is not covered

- Loss or damage is a result of wear and tear, depreciation, electrical or mechanical failure, mechanical defaults, repairs, loss outside the territorial limit, theft or attempted theft by any member of the insured household, loss/ damage to property if not accompanied by insured.

- Breaking of things that are brittle in nature apart from lenses.

- Damage to sporting equipment while being used at play unless this is caused by fire, theft, or accident. This affects cyclists, and golfers as they are required to specify their items to ensure they gate correct coverage.

- Damage and scratches of lenses and prisms unless damage also extends to property as well.

- Loss of cash and money-related instruments, title deeds, and manuscripts

- Consequential loss

- Loss and or damage as a result of delays, confiscation, or detentions by customs

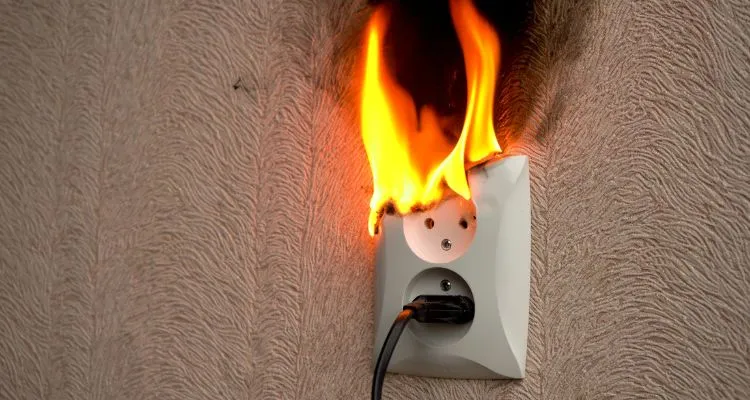

What if my electronic gadgets blow up because of shortcircuiting?

In this case, we usually advise that you add the electrical clause 3 clause under home insurance in Kenya which helps compensate you for loss or damage of your electronics caused by either:

- excess pressure

- short-circuiting

- self-heating or leaking of electricity

Domestic Workers’ Work Injury Benefits

Just like any employee, your domestic workers are entitled to benefits as stipulated by the WIBA Act of 2007 under your home insurance in Kenya policy. The is following injury, death, or occupational illnesses while working for you. It is important that you have a contract with your domestic workers. They include house help gardeners and watchmen.

The WIBA act stipulates the following benefits to be paid out:

- Death: 96 months of salary up to the specified limit

- Permanent total disability: 96 months salary subject to specified limits

- Temporal total disability: Up to 12 months’ salary

- Medical expenses: this will vary from company to company but not less than KES. 30,000

- Funeral expenses: As from KES. 30,000 per employee

Liability costs under home insurance in Kenya

Home insurance in Kenya provides some free liability covers and in the event, you want more liability cover, then you can be able to pay extra premiums for such. The liability sections will look at if you are the owner of the occupier.

Owners liability insurance

Insured in this case is either the landlord or homeowner is compensated for any cost and expenses in the event of:

- Accidental injury to any person other than a member of the insured family who is in service

- Accidental damage or loss to property not belonging or in the custody of the insured that occurs while within the insured property and only the owner nor occupier(tenant/renter) of the property is liable

Occupiers and personal liability

The insured in this case the renter or tenant is compensated following under the home insurance in Kenya policy:

- Accidental injury to any person other than a member of the insured family who is in service

- Accidental damage or loss to property not belonging or in the custody of the insured that occurs while within the insured property and only the tenant/renter not the owner/landlord of the property is liable

Home insurance cost Kenya

Based on experience, home insurance in Kenya is one of the most affordable insurance plans in Kenya. As from KES. 5000 a year, you can above all the above issues discussed. We have seen Safaricom home insurance a collaboration between Safaricom and Jubilee insurance offers monthly payments in conjunction with your internet payments. Read more on insurance in Kenya

Let’s engage today to get your home insurance in Kenya policy today !!