Best 5 Motor Insurance Companies in Kenya

When it comes to the best 5 motor insurance companies in Kenya, then look no further. We shall dive into the most comprehensive list of car insurance companies in Kenya by looking into the following critical areas:

- How much premium has been written as per the IRA 2021 report

- The volume of claims paid

- Pending claims

- Other interesting statistics such as motor vehicle insurance fraud.

Table of Contents

Types of Motor Insurance Offered in Kenya

The top vehicle car insurance companies in Kenya offer 3 types of car insurance covers:

- Third-Party car insurance

- Third-party, fire, and theft

- Comprehensive car insurance

How much is car insurance in Kenya

Since we have looked at the types of motor vehicle insurance offered by top insurers in Kenya, how much does car insurance cost in Kenya?

Comprehensive car insurance rates in Kenya

You are probably asking yourself: How much is comprehensive car insurance in Kenya? The top motor insurance companies in Kenya have a graded system when it comes to the rates applied. A sample of the cost of car insurance costs are:

| The estimated value of the vehicle | Estimated cost of comprehensive car insurance |

|---|---|

| Below 1,000,000 | 6%-7.5% with a minimum premium of 37,500-70,000 premium charged |

| Between 1M-1.5M | 5% charged with a minimum premium of between 45,000-60,000 charged |

| Between 1.5M-2.5M | 3.5%-4% charged with a minimum premium of between 60,000-75,000 charged |

| Between 2.5M and 5M | 3%-3.5% charged with a minimum premium of between 87,500-100,000 charged |

| Above 5M | 3% charged with a minimum of between 87,500-175,000 charged |

Third-party motor insurance price in Kenya

Most private car insurance third-party price in Kenya is almost the same across the industry with car insurance costing between Ksh. 7,574- Ksh. 15,108 per year. This is the lowest form and most basic form of car insurance we currently have in Kenya

When it comes to motor commercial, we shall look at the 2 options, the PSV Chauffer Driven and App hailing taxi service provider(Uber, Bolt, Little Cab) and Commercial vehicle.

As for the PSV Chauffer Driven and App hailing taxi service provider(Uber, Bolt, Little Cab), it is important to note that most companies do not offer coverage for this class of insurance for third parties, however, those that do, the cost starts as from Ksh. 9800 going up.

The average cost for commercial motor vehicles such as lorries and tippers among others are costed based on tonnage. The estimated costs are as below:

How much is 3rd party insurance in Kenya?

| Type of vehicle | Cost of third-party insurance in Kenya |

| Motor Private | As from Ksh. 7,574 |

| PSV Uber | As from Ksh. 9,583 |

| Motor Commercial (Based on tonnage) | As from Ksh. 7,574-Ksh. 35,000 |

What does motor insurance cover include?

The other question that comes up often is does a fully comprehensive cover include. Comprehensive car insurance in Kenya covers you for several things which include:

- Accidental damages whether self-involving or as a result of others

- Theft

- Fire

- Third-party liability

- Windscreen and window glass cover

- Radio cassette and music system cover

- Read more critical key areas of coverage of comprehensive car insurance here.

What do you need to get a car insurance quote?

When it comes to getting motor insurance in Kenya, you will be asked for the following details to facilitate a motor insurance quote:

- Year of manufacture. The current age limit for comprehensive car insurance is between 12-15 years and this varies from company to company.

- Value of the vehicle

- Make and model of vehicle

- Some companies will ask for the vehicle registration number

The next step would be to compare car insurance rates in Kenya, and that is where we come in. Compare motor insurance with us in seconds

Additional coverages you need for car insurance

Motor insurance in Kenya has extra benefits that come for free or at an additional cost and this will vary from one insurer to another. The free motor insurance benefits include:

- Riots, strikes, and civil commotion

- No blame no excess

- Windscreen and window glass cover up to between 30,000-100,000

- Radio and music systems cover between 30,000-100,000

- Towing and recovery services following an accident of between 30,000-100,000

The other paid motor vehicle insurance coverages include:

- Excess protector

- Political violence and terrorism

- Rescue services following the mechanical and/or electrical breakdown of the vehicle

- Courtesy car /loss of use/replacement of vehicle following an accident

We have discussed all these benefits in one of our comprehensive articles on motor vehicle insurance.

What does comprehensive car insurance not cover?

When it comes to motor insurance in Kenya, the following are not covered:

- Death or bodily injury of the insured

- Any person driving the motor vehicle or in charge of the motor vehicle for the purposes of driving

- Any person in the employment of the insured while

Motor Insurance Companies in Kenya

Regarding vehicle insurance in Kenya, IRA (insurance regulator in Kenya) has authorized the below companies to issue car insurance policies.

- AIG

- Allianz Now Jubilee Allianz

- Amaco

- APA

- Britam

- Cannon

- CIC General

- Corporate

- Directline

- Fidelity Shield

- First Assurance

- GA Insurance

- Geminia

- Heritage

- ICEA LION General

- Intra Africa

- Invesco

- Jubilee General

- Kenindia

- Kenya Orient General

- Kenyan Alliance

- Madison

- Mayfair

- Occidental

- Pacis

- MUA

- Pioneer

- Sanlam General

- Takaful

- Tausi

- The Monarch

- Trident

- UAP General

- Xplico

Top Car Insurance Insurers in Gross Written Premiums as at 2021

Regarding car insurance in Kenya, we shall look into the gross written premiums and the market share of the top 10 motor vehicle insurance in Kenya in terms of market share.

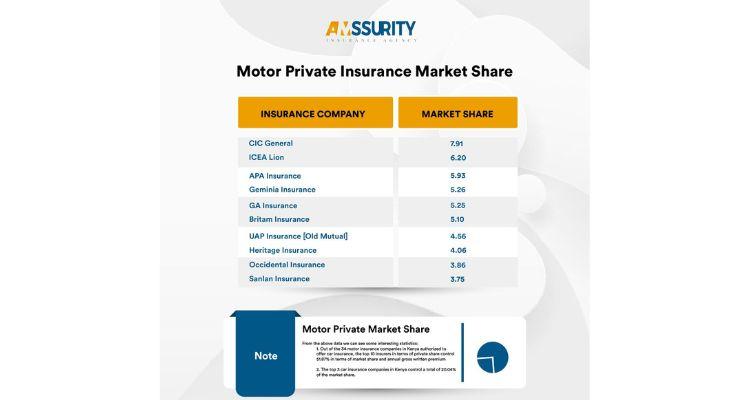

Motor Private Insurance Market Share

Motor Private Market Share

From the above data we can see some interesting statistics:

- Out of the 34 motor insurance companies in Kenya authorized to offer car insurance, the top 10 insurers in terms of private share control 51.87% in terms of market share and annual gross written premium

- The top 3 car insurance companies in Kenya control a total of 20.04% of the market share.

Motor Commercial Insurance Market Share

Motor Commercial Market Share

From the above data we can see some interesting statistics:

- Out of the 34 motor insurance companies in Kenya authorized to offer car insurance, the top 10 insurers in terms of private share control are 60.45% in terms of market share and annual gross written premium.

- The top 3 car insurance companies in Kenya control a total of 24.20% of the market share.

Motor Insurance Market Share

From the above data we can see some interesting statistics:

- Out of the 34 motor insurance companies in Kenya authorized to offer car insurance, the top 10 insurers in terms of private share control are 54.59% in terms of market share and annual gross written premium.

- The top 3 car insurance companies in Kenya control 21.01% of the market share.

If you are looking for the best motor insurance companies in Kenya, then look no further, we shall help you compare motor insurance rates in Kenya at no extra cost.